Founders: Come Reinvent Wealth Management With Us

By: Chris Chae, Gary Fung, and Jake Janosik — Venture Studio Leads @ Highline Beta

At Highline Beta, we build startups and invest primarily in the areas of fintech, insurtech, CPG, and health. Our Venture Studio spends a lot of time exploring these industries and developing a unique perspective on opportunity areas. The studio’s approach is to learn by doing, which means taking a hands-on approach to discovering, validating, and building new startups. We believe this firsthand experience leads to insights that you can’t simply find on Google, which in turn leads to the best startup ideas.

We’ve always had a keen interest in wealth management and are excited about the opportunities to build in the space. Our perspective is fueled by interviews and experiments we’ve conducted with 50+ users, as well as conversations with 25+ entrepreneurs, investors, and experts in the industry. We’ve validated (and invalidated) 50+ hypotheses based on feedback so far, which includes testing with existing solutions as well as our own prototypes. Our goal was to develop firsthand and unique insights into this opportunity area that would allow us to imagine, have conviction for, and build a better future within it.

One of the most interesting things we’ve witnessed is that the biggest driver of people’s behaviour with money is shifting away from risk-based portfolio construction to outcome-based planning across multiple dimensions. This doesn’t only include assets such as investments, banking, and taxes, but also factors such as health, identity, estate, ESG, D&I, and lifestyle. Yet today, most wealth management solutions are one dimensional. We’ve all tried online calculators or spoken to advisors who say, “give me a list of assets, liabilities & expenses and I’ll give you a date when you can retire.” Or worse, they try to sell us high-fee products without really taking the time to listen to what we need at a holistic level. Robo-advisors have helped reduce fees, but are only scratching the surface.

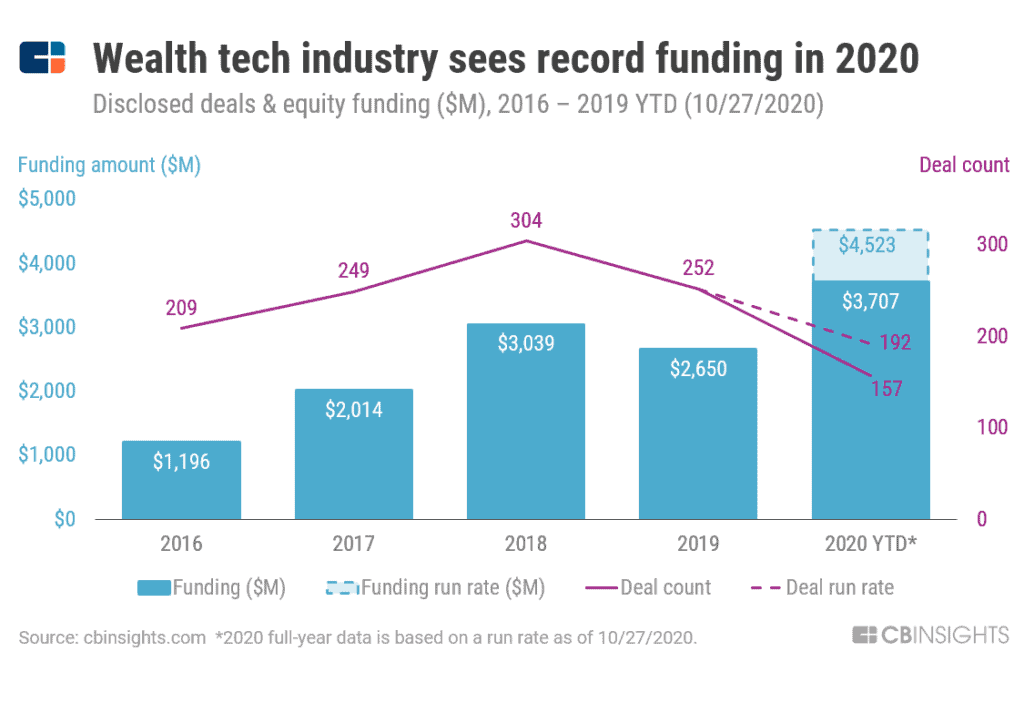

We are still at the forefront of innovation and growth in this market. According to CB Insights, wealthtech funding had already set a new annual record of $3.7B across 157 deals as of October 2020. This represents a 50% YoY increase from the same period in 2019. As well, 60% of deals made from 2015-2019 were early stage, which reinforces the notion that this space is still in its early days.

We have an opportunity to transform the relationship between people and wealth, in ways that lead to better financial outcomes for current and future generations alike. Some of the things we’re thinking about:

- How might we democratize access to wealth for underserved markets?

- How might we develop better solutions tailored to women, who are controlling a higher % of assets?

- How might we help people retain their sense of purpose as they transition into retirement?

- How might we continue to leverage emerging technologies, such as NFTs, to create or improve access to assets?

- How might we more equitably facilitate the transfer of wealth between generations?

- How might we create more effective methods for wealth education and knowledge?

- How might we help impending retirees manage the process of downsizing?

- And many more…

As we ask these questions, and continue to validate opportunities within wealth management, we want to find an entrepreneur, a Founder in Residence, that’s interested in joining us on this journey. If you’re interested in the wealth management space, and curious about building a startup with Highline Beta, we’d love to hear from you.