Corporate

Venture Studio

Our venture studio model quickly discovers and validates new growth opportunities. Our team of entrepreneurs operate as co-founders helping to quickly identify, test, and build new ventures. We believe that connectivity to enterprise businesses is critical for startups to thrive, so we help connect those dots, encouraging speed to scale in the market. We win when you win – and our goal is to help you do that as effectively as possible.

Selected Clients

Our Approach

Our Venture Studio team works with you to build the product, while finding a CEO – and we’ll invest alongside you to help build and scale an early stage company.

Discovery

Within 60 to 90 days, we identify several venture concepts addressing specific, meaningful problems faced by identifiable customer segments in a sizable market where you have a right to win and time-to-market is a premium.

Venture Validation

We validate at least one venture concept within the studio, providing clarity about its potential solutions, product roadmap, and go-to-market strategy. We provide the business case and recommend how to advance the venture concept.

Co-Creation / Build Internally / Partner / Buy

Whether you choose to build your new venture internally, co-create with Highline Beta in our studio, or partner with a startup, we work with you to find the right path — and invest right alongside you.

Selected Case Studies

How American Family Insurance partnered with Highline Beta to Build Relay Platform

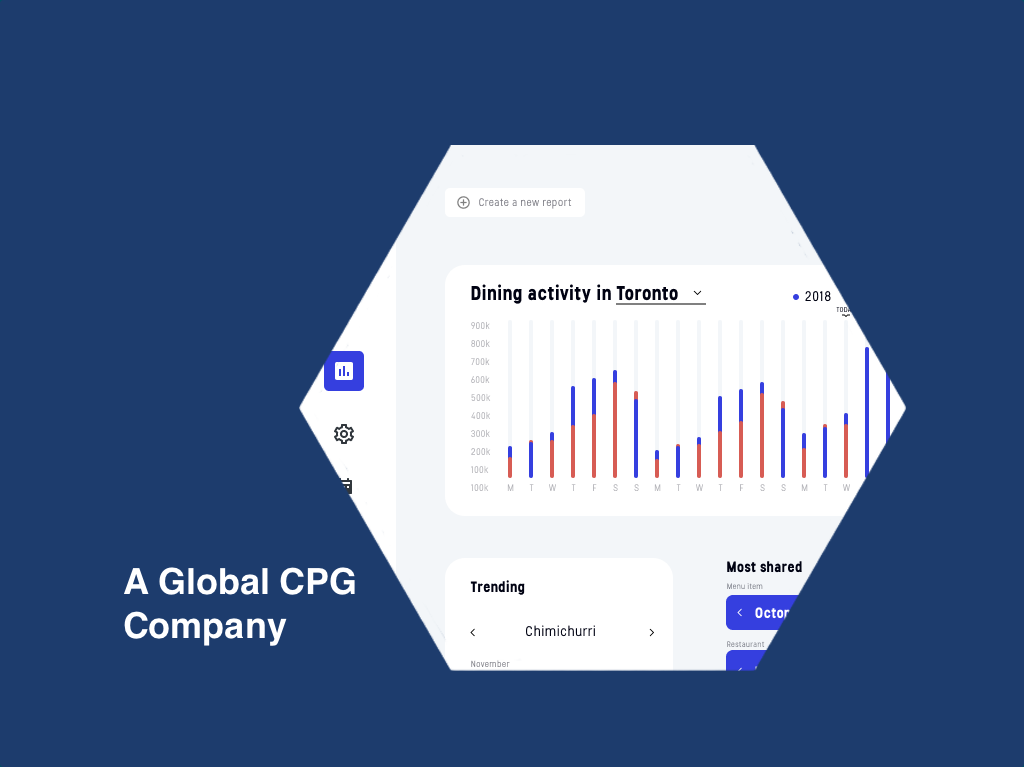

How Colgate-Palmolive worked with Highline Beta to discover and validate six new venture opportunities

GSC enlisted Highline Beta’s help to find new ways to innovate for healthcare

The Cincinnati Insurance Company

How Cincinnati worked with Highline Beta to discover and validate two new ventures

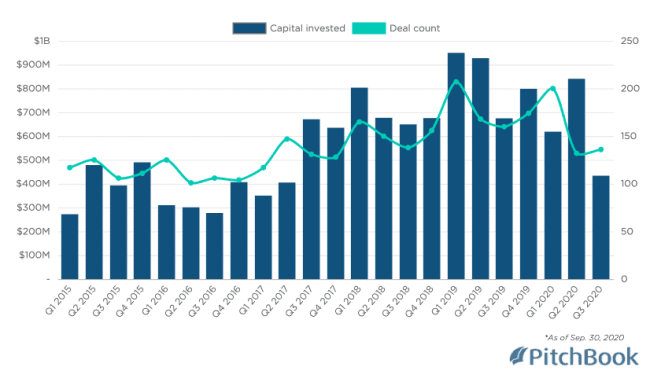

How Highline Beta helped people who cherish food get a better-informed bite

Our Expertise, Your Needs

Whether looking for a new revenue stream, trying to leverage an under-utilized asset, exploring how to solve a problem, or working hard on a solution already, we meet you wherever you are on your innovation journey. We’re always up for a quick conversation to see how we can help.

Let's Talk